We’ve written in the past about the increasing popularity of active adult, a growing asset class that has one foot in the senior living market and one foot out. Increasingly, active adult properties – which typically operate as age-restricted rentals with premium offerings ranging from fitness centers to hot tubs to rooftop bars to communal gathering areas – are catching the eye of investors both within and outside the senior living industry.

Case in point: earlier this month, a Chicago-based multifamily investment firm recently bought a 173-unit active adult property in the suburbs – for 40 percent more than it sold for a year ago.

In response to the growing interest in active adult communities, LivingPath has launched the first national database of active adult properties. Here’s a look at what a subscription to this data provides.

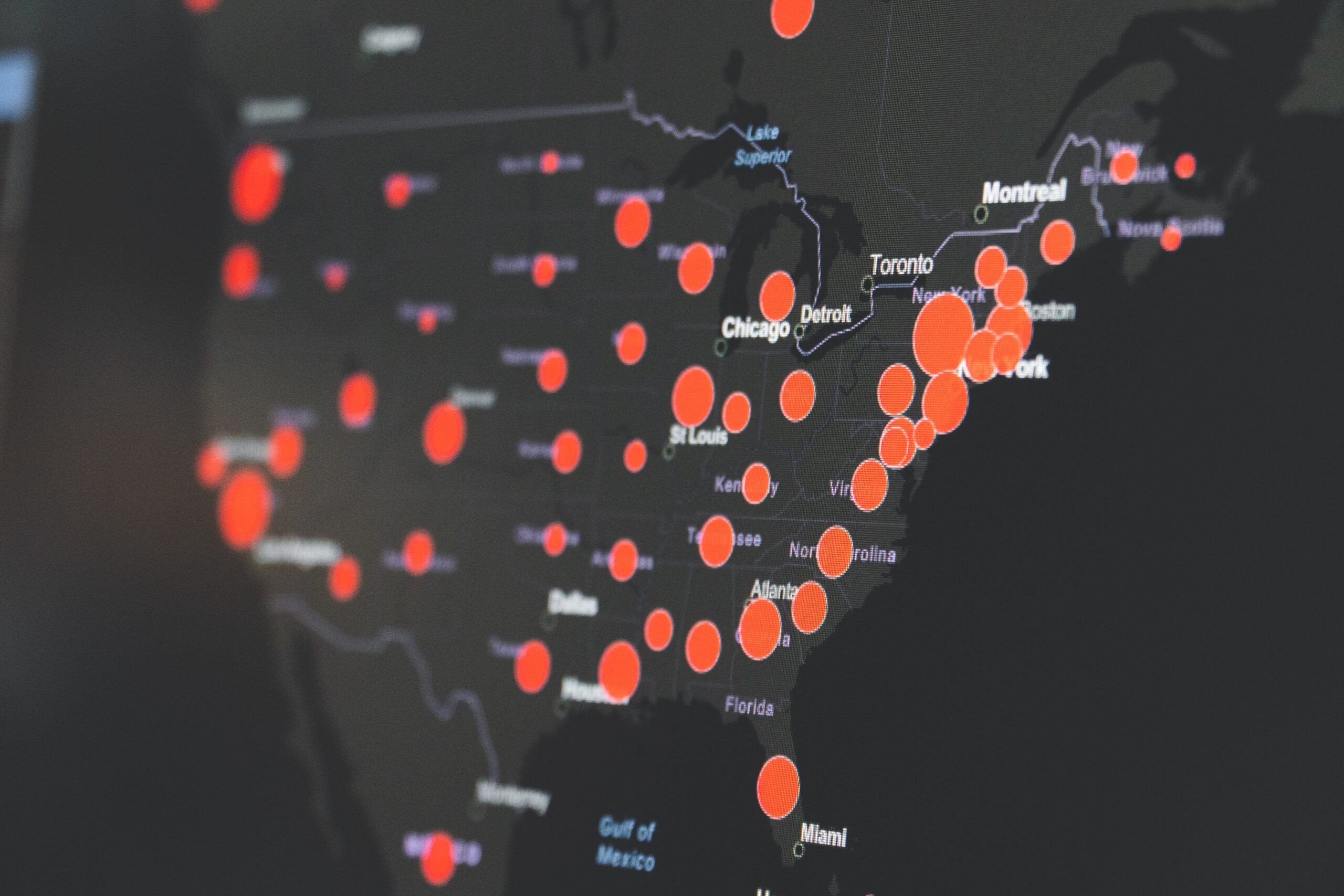

Current Active Adult Comps by MSA

At present, our database includes 500 active adult properties from the 30 largest MSAs. For our purposes, we’re using the following criteria to delineate “active adult” properties:

- Age restriction (55+, 62+, 65+, etc.)

- Apartment structure (not single-family or manufactured homes)

- Rental only

- Market rate units

- No commercial kitchen

In fact, those criteria help illustrate why this asset class is so popular right now. Staffing needs are similar to what any multifamily rental property would require, but the age restriction and addition of key premium add-ons (or proximity to premium amenities like entertainment or shopping centers) justify a premium to multifamily rates.

Our database (updated quarterly) includes addresses, building data, occupancy, and current rental rates by unit type for each property. It also includes information about each property’s developer and operator.

Data Filters to Drive Research

Our active adult database is searchable by market (location), building vintage, developer, and operator. It also includes properties in the construction pipeline, offering in-depth market intelligence for developers and operators looking to enter or expand into the active adult space.

Because the database is updated quarterly, it also serves as a valuable gauge on current rate trends at comp communities by region, age, developer, operator, or profile.

For more on rate trends in the industry, check out our market intelligence products, which feature data on rate, occupancy, and more for the public and private markets.

Market Trends in Active Adult

By 2030, one in five Americans will be 65 or older. By 2040, the number of renters in this group is expected to increase by 74 percent (from 7.4 million today to 12.9 million). That translates to substantial need for housing to accommodate them nationwide.

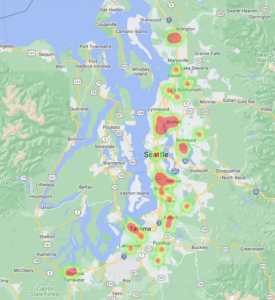

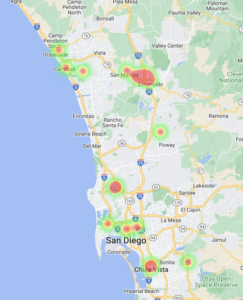

More relevant to individual operators and developers, though, is what’s happening in specific geographic areas, which can help determine where the greatest need – and opportunity – lie (see Figures 1 and 2)

Figure 1: Heatmap of Seattle-Tacoma-Bellevue area active adult communities

Figure 2: Heatmap of San Diego-Chula Vista-Carlsbad area active adult communities

Access the Only Comprehensive Active Adult Market Intelligence Database

As of today, LivingPath is the only organization offering access to comprehensive data on the active adult market at the national level. We’re making the full database available via subscription.

If you’re interested in learning more about the data we track, or if you’re interested in access to data on independent living, assisted living, or memory care communities, get in touch. We’d love to help you craft the dataset that best meets your quarterly, yearly, or occasional research and planning needs.